For Australian firms, handling and lodging Business enterprise Activity Statements (BAS) is mostly a crucial facet of maintaining compliance with tax legislation. BAS expert services are made to streamline This method, making certain corporations meet up with their obligations to the Australian Taxation Business (ATO) while minimizing errors and time personal savings.

What exactly is BAS?

A company Exercise Assertion (BAS) is often a tax reporting document that individuals use to report and spend quite a few tax liabilities, including:

Items and Services Tax (GST)

Shell out When you Go (PAYG) installments

PAYG withholding tax

Fringe Benefits Tax (FBT) installments

Other taxes, based on the small business composition and functions

BAS is often lodged regular, quarterly, or on a yearly basis, according to the sizing and sort from the small business.

The Purpose of BAS Products and services

BAS products and services give Specialist assistance in planning, examining, and lodging Organization Activity Statements. These expert services are delivered by registered BAS agents or capable accountants with experience in tax compliance.

Core Features of BAS Services:

Correct History Keeping: BAS agents assure all financial transactions are precisely recorded and classified, forming the premise for appropriate BAS calculations.

GST Calculations: They estimate GST on gross sales and buys, guaranteeing companies assert suitable credits and fulfill their payment obligations.

Compliance Monitoring: BAS agents stay updated on tax regulations and ATO specifications, making certain companies continue to be compliant.

Lodgement Support: Brokers get ready and lodge BAS punctually, staying away from late penalties and desire prices.

Error Reduction: Professional overview of money knowledge cuts down on probability of errors, be answerable for expensive audits or penalties.

Advantages of Qualified BAS Solutions

1. Time and Anxiety Price savings

BAS preparing might be time-consuming and sophisticated. Outsourcing a specialist to gurus lets companies to center on operations and growth.

2. Compliance BAS services Mona Vale and Precision

Specialists make particular that BAS submissions are error-no cost and compliant with ATO rules, offering reassurance to businesses.

3. Income Circulation Management

BAS brokers give insights into tax liabilities and credits, serving to enterprises regulate cash flow improved.

4. Hazard Mitigation

Pro handling of BAS cuts down on probability of audits, penalties, or disputes with every one of the ATO.

Selecting the Suitable BAS Services

Seek out registered BAS agents with demonstrated skills in your industry. Make certain they may use contemporary accounting computer software, are available, where you can robust track record of timely lodgements.

BAS expert services are an essential useful resource for Australian firms, simplifying tax reporting and fostering monetary compliance and security. By partnering with experts, enterprises can meet their obligations even though concentrating on achieving their established plans.

Jonathan Lipnicki Then & Now!

Jonathan Lipnicki Then & Now! Charlie Korsmo Then & Now!

Charlie Korsmo Then & Now! Christina Ricci Then & Now!

Christina Ricci Then & Now! Sydney Simpson Then & Now!

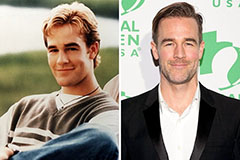

Sydney Simpson Then & Now! James Van Der Beek Then & Now!

James Van Der Beek Then & Now!